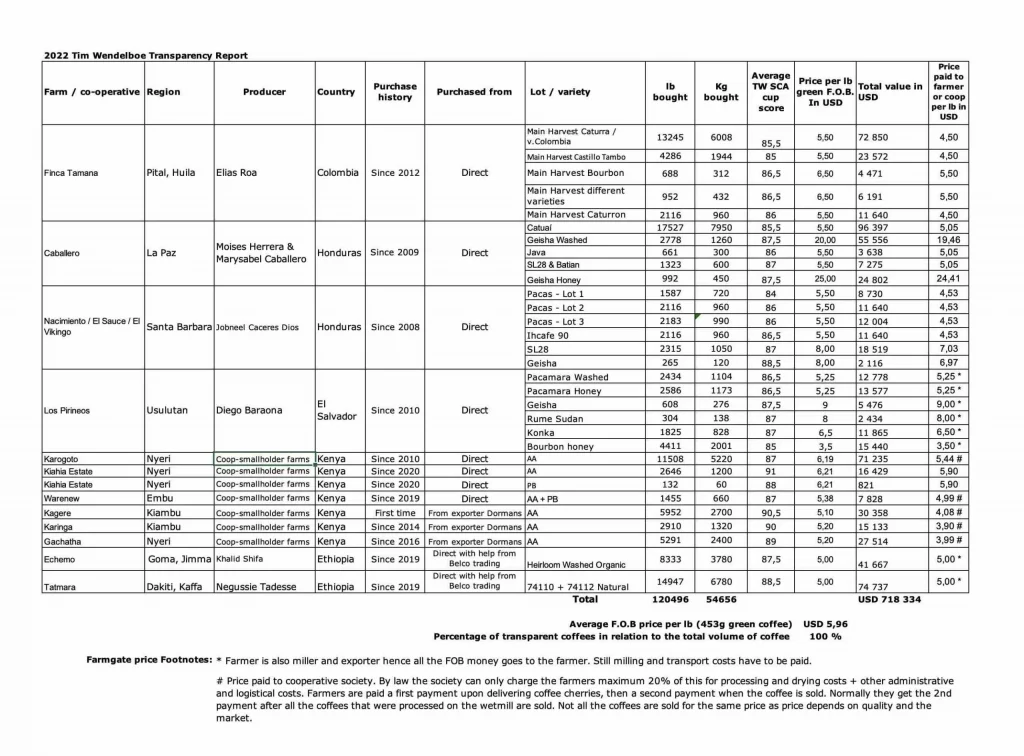

Here is our annual transparency report for the green coffees we bought in 2022. We highly recommend that you keep on reading the text on this page too as it will give you a thorough explanation of the report and what the numbers all mean. Before we go in to details about all the places we buy coffee from here is a little summary of the year 2022.

Like in 2021, the first half of 2022 was affected a lot by the Covid19 pandemic and due to travel restrictions we were not able to visit most of the farms we buy coffee from. Fortunately we have been buying from and worked with most of these producers for many years which means they know what samples we are looking for and most of them also produce coffees specifically for us. This means that we are still able to buy fantastic quality coffee from all of them without having the need to visit their farms to follow up on quality control and development every single year.

In general the quality of the coffees in 2022 was slightly above average, but what exited us the most was that we started to get a lot more variation of flavours from each farm we buy from as most of them are now producing several great tasting cultivars in good quantities. Some of the highlights in 2022 were for sure the coffees from Los Pirineos that showed a general increase in quality from previous years.

Another highlight was the coffee from Kiahia estate in Kenya, a small farm that produce one of the best SL28 coffees I have ever tasted. We also managed to get good qualities from Negussie and Khalid’s farms in Ethiopia and we are planning on working more closely with them in the years to come so that we can help them implement better and more strict quality control in order to increase the quality of their coffees to new levels.

About the transparency report

This is our 13th annual transparency report. Our first report was published in 2010 and since then we have published how much we buy and what we pay for the green coffee we purchase every year. But looking at the prices and volume alone does not tell the full story. We believe it is important to explain the report in more detail and also give you a better understanding of how our coffees are purchased and handled in the various origins we buy from. But first you will need a little bit of background information as to why we started publishing our transparency reports int he first place.

The Pledge

In 2019 we signed The Pledge which is a joint project made to establish a common code for transparency reporting in the coffee industry. We believe this initiative is extremely important as there is still a lot of resistance from roasters, both small and big, against being transparent. It seems that everyone likes the idea of transparency, yet there are just a handful of roasters in the world that are willing to actually show what they are paying for their green coffee. Phrases like “we pay more for quality” or “we support the farmers” become meaningless if you are not able to back it up with real facts and numbers. If you are actually paying more and supporting farmers, then there should be nothing to hide in our opinion.

But how much is more and is it enough?

Roasters have often referred to the C-market price when they talk about the market price for coffee. If you pay more than the c-market price it does not automatically mean that you are supporting the farmers or paying a fair price for your coffee.

This is because the c-market price is the market price for «commodity coffee», the coffees you’ll typically find in super markets, and not high quality coffee or what people refer to as “specialty coffe”. The C-market price in 2022 fluctuated from around 1,50 – 2,60 USD per lb. Although the prices were higher than in 2021 and for the majority of the year also higher than the production cost, 2022 was an abnormal year with higher than average prices due to climatic conditions affecting the coffee production. If we look in longer terms, in most cases the producers are barely able to cover their production costs and there are few that can make a decent living out of producing coffee for the commodity market. It is therefore quite common that the coffees sold in the commodity market are not produced with quality in focus but rather quantity and cost efficiency in mind. Quality focused «specialty roasters» should therefore not use this price as a benchmark for what they are paying for coffee as it is not the correct market price for quality coffee.

The Specialty Coffee Transaction Guide

Fortunately we now have a new benchmark for what the market price for high quality coffee is. The Specialty Coffee Transaction Guide has been developed by some brilliant people at Emori university. Based on data from more than 70 data donors, among them roasters, importers, exporters and farmers, they have been able to create a guide showing what the real market price for high quality coffee is. Of course they take in to account that different volumes, qualities and origins will have variation in prices. This is is all described in detail in the guide. We believe this is important as now both farmers, exporters, importers, roasters and the public will have a better understanding of what the actual market price for quality coffee is. It means that when a roaster like us claim to be paying a fair price for the coffee, you finally have valid standard to compare the prices against and that average price is somewhere between 2.83 to 4.48 USD per lb F.O.B. depending on quality, quantity and origin.

Why transparency?

To understand what a sustainable price for coffee is we need openness and transparency around the economics of coffee. For many years the coffee c-market price has been below production cost of coffee which is obviously not sustainable for most coffee producers. We use a lot of energy throughout the year showing our followers what it actually takes to grow and produce high quality coffee and therefore we believe it is important to show you what we actually pay for it. After spending over 2 months at Finca Tamana every year since 2015 I have also gotten a better insight to how a farmer thinks and what is important to them.

Therefore posting what we pay for our green coffee is not only a tradition for our company but we do it because we want to inspire other coffee companies and show them that it is possible to build a profitable business and still pay a fair price for coffee.

We also do it so that farmers who are selling quality coffee and might not be aware of what other roasters are paying for similar coffees in the market, can use it as a tool or a reference when they negotiate prices. Making sure that the coffee producers are paid a sustainable price is key to keeping our industry alive and secure our future supplies of quality coffee. If you love coffee and want to continue drinking it, then it is the only way we can move forward.

Below we will try to explain a bit more in depth the information in our transparency report and also explain a little bit how we work in the different origins we buy from.

What does F.O.B. price mean?

F.O.B means «Free on Board» which means the price for the coffee packed and stacked in a container delivered to the ship. The price is stated as the price per pound (lb) which is equal to 453 grams of green coffee. The reason why we use this price and for example not the «Farm Gate» price (price paid to farmer) is because this is the most common way of communicating price and is the agreed way of communicating prices in The Pledge.

So, when we state the F.O.B. price it means that for example when we pay USD 5,- per lb F.O.B. for coffee from Elias and his farm Finca Tamana in Colombia, he only get’s USD 4,- per lb. Why? Because the coffee needs to be transported to the mill, milled, packed and again transported to port. Samples also needs to be sent to Norway for approval and local coffee taxes needs to be paid. This work is managed by an exporter, in this case our friend Alejandro Renjifo and his company Fairfield Trading. Alejandro also has personnel cost and rent to cover and also executes quality control in the milling and delivery process. In some cases the farmer is his own exporter and miller and in other cases where we are buying through a cooperative structure the cooperative also need to get a cut for administration costs, wet milling, pre-financing of farm inputs, school fees, etc.

The F.O.B price is not a perfect indicator of what the farmer was paid, but when you have a transparent value chain and also as few “middle men” as possible it means the farmers will still get the majority of the F.O.B Price. Having said that, if the F.O.B. price is very low, the farmers pay check most certainly was lower, so at least the F.O.B price will give a good indication wether the buyer paid a fair price for the coffee or not. The coffee community are still debating wether the F.O.B. price is the correct one to report or if it should be the farm gate price (price paid to farmer). We believe if the value chain is transparent and the producer gets a fair cut of the price and also a sustainable price for his / her coffee it can be reported in any way you want. But we need a standard. Having a common benchmark is a good thing and now we finally have one that is relevant to our part of the coffee industry. I often find that the biggest critiques of F.O.B. price reporting are those who are still not so keen on being transparent. So let us rather spend our energy on encouraging more people to make their business transparent and pay sustainable prices to the coffee producers, rather than wasting it on technicalities of our reporting.

Country, Farm / Cooperative, Purchase history and who we buy from.

In 2022 we mainly bought our coffees directly from farms and cooperatives but every country and farmer have a different supply chain. I will try to explain them briefly here so that you can understand a bit more how we buy our coffees.

Finca Tamana – We buy coffee directly from Elias Roa, the farmer. Fairfield Trading, the exporter, provides milling and logistical service and the coffee is imported by ourselves directly to Norway. We have been buying coffee from Elias every year since 2012 and we will continue to do so in future years.

Caballero – We buy coffee directly from Marysabel Caballero and Moises Herrera, the farmers. They mill and pack their own coffee. Boncafe, the exporter, provides logistical service and the coffee is imported by ourselves directly to Norway. We have been buying coffee from the Caballeros every year since 2009 and we will continue to do so in future years.

Nacimiento – We buy coffee directly from Jobneel Caceres Dios, the farmer. San Vicente, the exporter, provides milling and logistical service and the coffee is imported by ourselves directly to Norway. We have been buying coffee from Jobneel every year since 2008 and we will continue to do so in future years.

Los Pirineos – We buy coffee directly from Diego Baraona the farmer. He mills and packs his own coffee. He is also the exporter. The coffee is imported by ourselves directly to Norway. We have been buying coffee from Gilberto (RIP) and now his son Diego every year since 2010 and will continue to work with them in future years.

Kenyan coffees – So far we have mainly been buying through what is called «direct sales» in Kenya. We try to buy from the same wet mills (organised under a cooperative society) every year but have also been shopping around based on availability and quality. In some years political situations have made buying challenging. This means that some wet mills we have bought from for many years (yet some years we have not been able to), and others we might have bought from once before. Every year we cup through «direct sale offers» from C.Dorman and also in 2022 from Ibero and Kahawa Bora. Once the selection is made we offer a price based on USD per 50kg bag of green coffee that is negotiated with the cooperatives. This price is what is paid for the coffee to the cooperative and is negotiated with the help of a marketing agent that the different wet-mills / factories have selected to use. Once the price is agreed upon, the marketing agent adds their fee, the exporter adds their milling, finance and logistical cost to the price which becomes the F.O.B. price.

We have also bought coffees from the exporter C.Dorman. In these cases, C.Dorman bought coffees at the Kenyan coffee auction with the intent of selling the coffees to their clients afterwards. The prices paid on the auction is still transparent but farmers and cooperatives prefer to sell “direct” so that they do not have to pay the auction fees and they tend to fetch higher prices too through direct sales.

The farmers sell coffee cherries to the wet mills (factories owned by the co-operatives) and deliver cherries several times during a harvest. The farmers are paid a price based on all the coffees they sold to the cooperative that year. (not just the one we bought) The wet mill will process and dry the coffees before they get sent to the local mill for storage. Therefore the cooperative by law charges no more than 20% of the selling price of the coffee. Most of the wet mills we buy from publish the prices they are paid for their coffees on their notice boards for the farmers to see and everything is recorded in their accounting. However I still know that we can get better at providing transparency in Kenya and I really hope to step up our buying protocols and find more long term partners in Kenya in the years to come. All coffees are imported directly to Norway by ourselves.

Ethiopian coffees – In 2019 we changed the way we buy coffees in Ethiopia due to a change of legislation in Ethiopia, making it easier for roasters to buy directly from small to medium sized farms in Ethiopia. The goal is to buy directly from farms also in Ethiopia and to be able to provide full transparency like we do in Central- and South America. In 2022 all of our Ethiopian coffees were bought with the help of the French importer Belco Trading. We negotiated price directly with the farmers and in addition paid the importer for logistical service such as sending samples, moving the coffees inside of Ethiopia, pre-financing the coffees. The farmers are the official exporter of the coffee to Norway.

Echemo – Echemo is a small farm owned by Khalid Shifa who is also an exporter of coffee. We met Khalid through the French import company Belco Trading and visited his farm in December 2018 and 2019. The F.O.B. Price was paid to Khalid, but milling and transportation inside Ethiopia was paid by him. Belco added their margin to cover their expenses for helping us move the coffees and communicating and organising logistics with Khalid. They also charged for shipping and organising logistics from Ethiopia to Norway. Belco is also providing valuable support to farmers like Khalid in terms of training in agronomy and processing techniques and they help market and sell the coffee to roasters.

Tatmara Coffee Plantation – Tatmara is a small to medium sized farm farm owned by Negussie Tadesse who is also an exporter of coffee. We met Negussie also through the French import company Belco Trading and visited his farm in December 2018 and 2019. The F.O.B. Price was paid to Negussie, but milling and transportation inside Ethiopia was paid by him. Belco added their margin to cover their expenses for helping us move the coffees and communicating and organising logistics with Negussie. They also charged for shipping and organising logistics from Ethiopia to Norway. Belco is also providing valuable support to farmers like Negussie in terms of training in agronomy and processing techniques and they help market and sell the coffee to roasters.

Lot / Variety and TW SCA cup score

We do buy many different lots every year. Even from the same farm, such as Finca Tamana, we can end up buying 8 lots of the same variety separated by harvest date, screen size or quality. So even though we carry the same coffees year after year, we can go through over 80 – 100 different lots of coffee in a year. The price we pay for each lot can vary based on availability, market price and potential selling price. For instance the Catuaí coffee from the Caballeros is a coffee that they produce a lot of and in all fairness it is quite easy to find similar cup profiles from other farms (although not the same quality.) The fact that my personal cupping scores are quite high reflects that in this product category it is a very well processed and sweet coffee with clear flavour attributes. Their Geisha coffee has a very different cup profile and although I only scored it slightly higher it has a lot higher price. This is due to the fact that I score it with a reference to other Geisha coffee and also that the availability of Geisha coffees both from the Caballeros and in general is quite limited. Geisha lovers are also willing to pay more for this rare coffee and there are many roasters who would like to get their hands on some rare Geisha. For me they are completely different products where I would compare the Catuai to a dark beer, the Geisha is almost like a fragrant white wine. ( Needless to say I love drinking both of them.)

The SCA cup score is based on the SCA cupping protocol with a scoring scale from 0-100 where «specialty coffees» range from 80 points and above. Although I haven’t gone through a calibration since I certified as a q-grader some years ago I still feel that I am quite well calibrated with the cuppers I taste with around the world and my score is normally only a point or so off from the local cuppers where I buy the coffees. The scores on the report is either the actual score of the lot we bought if there was only one lot, or in the case of Caballero’s Catuaí or Geisha, the average score I gave to all the lots we bought from them of that particular cultivar.

LB / KG bought and average F.O.B. Price

I have seen some transparency reports where only part of the coffees that a company bought was published in the report so that the numbers looked really good. For me it is important to show the price of all the coffees we buy. We have nothing to hide yet we also haven’t reached our goals of buying everything as direct and transparent as we want to. So the total amount of kilos presented in the report is actually the grand total of all the coffees we bought.

As you can see, the average price we paid per lb of green coffee last year was USD 5,96. You may wonder if this is a high price or a low price? Well, we finally have a benchmark to refer to in The Specialty Coffee Transaction Guide. The average for the higher priced coffees in the guide is at USD 4,48 per lb. This shows that we actually are paying more for our coffees, but what it does not tell you is what the cost of production was and whether the farmers are actually making a healthy profit or not. We know that producing quality coffee cost more and also involves more work at farm level. These costs can be challenging to calculate and to be honest I don’t know exactly what the costs are on each farm. All I can say is that I do see a lot of progress on the farms that we have been working with and buying from in Central-America and Colombia. The coffees we are buying there are for sure increasing in quality year after year. I really hope to be able to have a similar positive impact and find new long term partners in both Kenya and Ethiopia in the years to come.

Thank you

I would like to finish this post by giving my gratitude to all our guests, customers, subscribers, followers and supporters that every day help us sustain our business so that we can continue pushing for a more sustainable coffee production. I know I have just briefly touched on the economics in this post and I am completely aware that social, ecological and environmental issues also needs to be addressed before we can even start thinking about using the word sustainable in our marketing. However making sure that the farmers are actually able to make money instead of losing money is the first step on the way to make their production more sustainable in all aspects.

Thank you.

– Tim W